‘Minimal increases’ in state aid fit decade trend, town officials say

Over the last decade, state aid to the town of Dartmouth has remained “stagnant,” forcing the budget to rely on local receipts and taxation, according to Gary Carreiro, treasurer and director of budget and finance and interim co-town administrator.

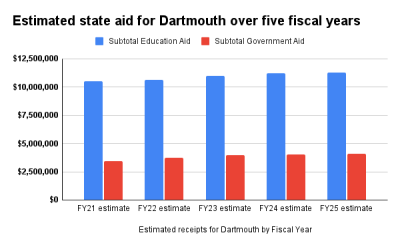

And this year appears no different, he said. On July 29, Gov. Maura Healey signed the Fiscal Year 2025 budget, which began July 1, 2024 and will end June 30, 2025, with government aid up 1.4%, bringing the estimated contribution for Fiscal Year 2025 to $4,106,832. Education aid is up by 0.57%, bringing the state’s estimated contribution to $11,308,610.

Over the last decade, state aid to the town of Dartmouth has remained “stagnant,” forcing the budget to rely on local receipts and taxation, according to Gary Carreiro, treasurer and director of budget and finance and interim co-town administrator.

He added he wasn’t surprised with what the estimates were in the state’s budget given this recent trend.

“When I developed the budget for the town, I use pretty much dollar for dollar what the state gives us,” Carreiro said.

He explained the reason state aid has only seen “minimal increases” to the town is because Dartmouth is seen by the state as “a socioeconomic community that can support its own on a tax rate.”

Though the town does receive aid, he said it is not to the extent of communities like New Bedford, Fall River or Springfield because it hasn’t been deemed necessary by the state.

For example, Carreiro highlighted the Chapter 70 funds, or school aid from the state, which has seen an increase of $600,000 over the last five fiscal years.

“It may seem like a lot, but it's really not a lot,” he said, adding how although he cannot speak on behalf of the schools, their state aid has also been “pretty minimal.”

For Fiscal Year 2025, Chapter 70 funding is up 0.94%, bringing the state’s estimated contribution to $10,547,851.

Carreiro emphasized the stagnancy of this aid forces the town to rely on taxation and local receipts, which includes motor vehicle tax, fines and permits that departments generate.

At the last School Committee meeting, board members discussed the need for a Proposition 2 ½ override for Fiscal Year 2027 if they cannot find another solution to the budget deficit.