Tax override among options to bridge serious budget gap for Dartmouth Public Schools

The town needs money — more than it expects to collect — to fund Dartmouth Public Schools.

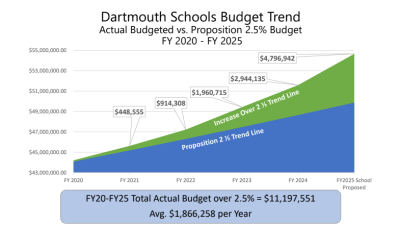

Costs are rising across the board, but particularly for the school system, and the typical property tax increase of 2.5%, the maximum allowed by the state, will not cover the estimated expenses for fiscal year 2025.

One option? Ask residents for permission to raise their own taxes higher than that.

“There’s going to be a certain segment of people out there that say “No,” because nobody wants to raise their own taxes — I understand that, I don’t want to raise my own taxes,” said Select Board member Shawn McDonald. “But I also want to make sure my town does what it needs to do to support its entire community.”

The alternative may be severe cuts to school district staff — to the tune of 12.5 full-time employees.

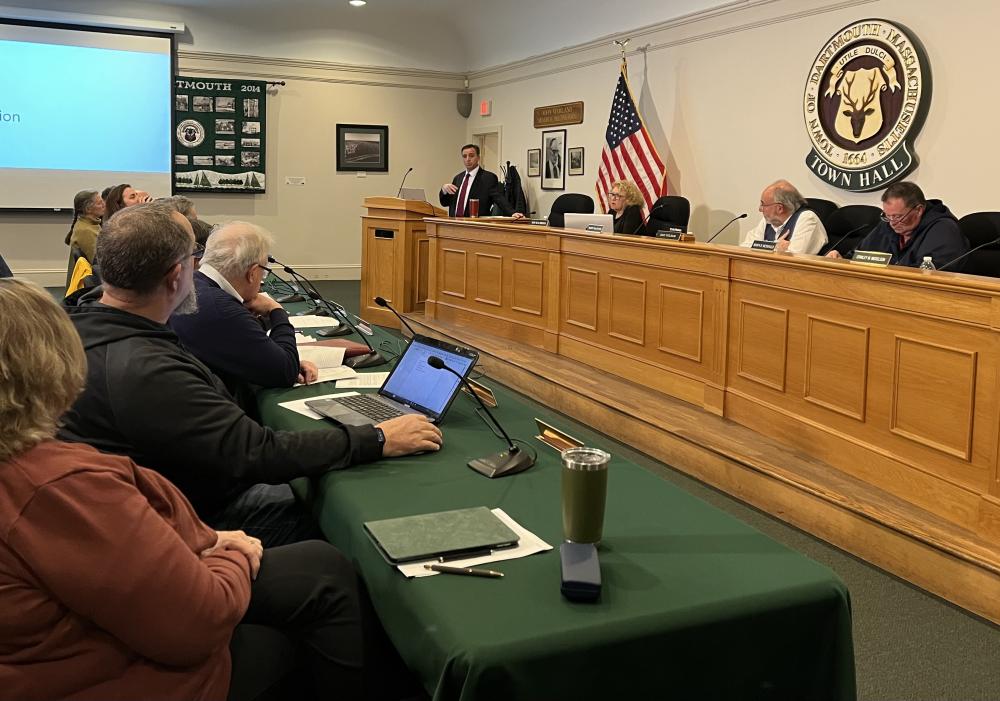

Town Administrator Shawn MacInnes outlined the problem at a rare joint meeting between the Select Board, School Committee and Finance Committee on Dec. 11.

“We want to look at [the budget] and say ‘How can we solve the problem moving forward?” MacInnes said.

How Dartmouth got here

The town is missing an estimated $1.52 million that the school district needs, according to school administrators, to largely maintain the same services the district currently provides. The district estimates another $825,000 increase for fiscal year 2026.

The budget problem has been on the horizon for years now: in May, the town moved one-time funds around to bridge similar gaps in the fiscal year 2024 budget, but vowed to address the trend next year.

Rising costs include a 5% increase in the cost of special education programs, a 15% increase in the cost of transportation services — a service that continues to increase in price across the Commonwealth — and a 36% increase in legal services, which stems from the retirement of the district’s lawyer.

Another $181,190 stems from new budget changes, including the hiring of an ESL teacher and a behavioral specialist, technology replacement and new curriculum materials. Some of those costs were offset by the elimination of two elementary school teacher positions and a secretary position.

In addition, nine staffing positions are currently funded by a federal Covid relief fund, but the town will soon need to pick up the tab.

Inflation has also raised costs across nearly all town departments.

How Dartmouth could bridge the budget gap

The town has a few options.

Unsustainable ones include taking funds from free cash or tapping into stabilization funds, which are typically used for unforeseen one-time expenses and refilled as soon as possible.

But the most attractive option — and the one which several Select Board and School Committee members expressed interest in — is the tax override.

Pushing an override is not an easy task. The action would need to pass both a Town Meeting vote and a town-wide referendum.

As presented at Monday night’s meeting, the override would fund the budget shortfalls for both fiscal year 2025 and 2026 at the same time, which would cost taxpayers $2.34 million collectively.

According to the town’s estimates, residents would, on average, pay an additional $149.60 in property taxes in the event of an override. That number would fluctuate based on the assessed value of a resident’s home.

In the past year, both Westport and Fairhaven voters turned down override requests after Town Meeting approved them. The Standard Times reported that Westport’s override failure cost the town a firefighter, a police officer, an assistant building inspector and technology upgrades.

Dartmouth Public Schools estimates it would lose 12 and half full time employees without a funding source to bridge the fiscal year 2025 shortfall.

The school system does have another funding source not mentioned by the town: funds from the state’s school choice program, where Dartmouth receives tuition for accepting out-of-district students. School Committee Vice Chair Chris Oliver said he would be “comfortable” spending some of that money on one-time purchases if an override was passed.

In the School Committee’s own Dec. 11 meeting after the joint meeting, member Shannon Jenkins said the committee should use the school choice funds to cover a few of the one-time purchases on the budget, including $200,000 of technology replacement and $150,000 of curriculum materials.

“In order to move forward and convince this town and the people in it about the premise of an override, we need to show we’re doing our due diligence on this side,” Oliver said.

How Dartmouth compares to similar communities

Seeking to put a potential override in context, MacInnes said Dartmouth has some of the lowest taxes among “comparable communities,” meaning municipalities that are similar in size and structure to Dartmouth.

At the same time, MacInnes said Dartmouth Public Schools spends less than most of those communities do on their school districts.

Oliver put a further point on it. Citing data points provided to him by Assistant Superintendent James Kiely, Oliver said Dartmouth ranks near the bottom compared to all school districts across the state in overall spending, teacher spending, operations spending and insurance and benefits spending.

“We’re not in the top 30, we’re not looking to be in the top 30,” McDonald said. “We’re getting to a level where we need to sustain, where we can continue.”

Dartmouth spends about 57% of its budget on the school system, and about 71% of its revenue stems from property taxes.

“This is not like a pie-in-the-sky, bells-and-whistles sort of budget,” Jenkins said. “This is to continue doing what we’ve been doing.”

What an override campaign would look like

The three boards will each consider the options, and return at the next Select Board meeting on Jan. 8 to make a more concrete decision.

If the Select Board voted to pursue an override, the town would either be on a tight timeline to schedule a special Town Meeting and get the override on the April 2 election ballot, or would need to hold a special election at a later date for the referendum.

Town officials and elected representatives would then need to provide as much information as possible to residents about why an override is being requested and what the action would mean.

McDonald said providing residents with the exact costs of voting “Yes” and the exact consequences of voting “No” will be key to the effort’s success.

“Some of these people just can’t afford it,” McDonald said. “We have the duty and diligence to show them, you might not be able to afford this, but in the long term, this is what we need to do.”

Finance Committee member William Boles said the town will also need to communicate how the school system affects residents without kids in it.

“If the level of school quality goes down, so does your property value at the same time,” Boles said. “If we have a lousy school system, your house isn’t going to be worth that amount of money.”

Other board members said that the schools are a major force in the community, and should be treated as such.

“Dartmouth’s public school system gives Dartmouth the greatest amount of pride,” said Select Board member Heidi Silva-Brooks.

Select Board Chair David Tatelbaum said he doesn’t want to treat the override as a foregone conclusion, and that the town can only provide the information and let residents make up their own mind.

“The question really is, to us and to our residents in town: What do you want for the Town of Dartmouth? What kind of school system do you want?” Tatelbaum said. “If we don’t want to spend that money, we’ll end up with a school system that goes backwards, and if that’s what the town votes and wants, so be it.”

While the current budget discussion is explicitly focused on the school district’s gaps, MacInnes and Tatelbaum also reminded the other boards that the town needs to address long-term capital plans, including a new sewage treatment plant.

Separately, the town wants to reevaluate its employee health insurance split. The latter problem garnered a citizen petition on the October Town Meeting warrant asking to improve the town’s contribution to health insurance premiums, but the article was deemed illegal for Town Meeting to vote on.