Ahead, LLC seeks tax relief to fund expansion

Ahead, LLC, a New Bedford-based manufacturer of headwear, apparel, and accessories, is looking to expand its operation, and company representatives are seeking town approval of a tax agreement that they say will make the expansion possible.

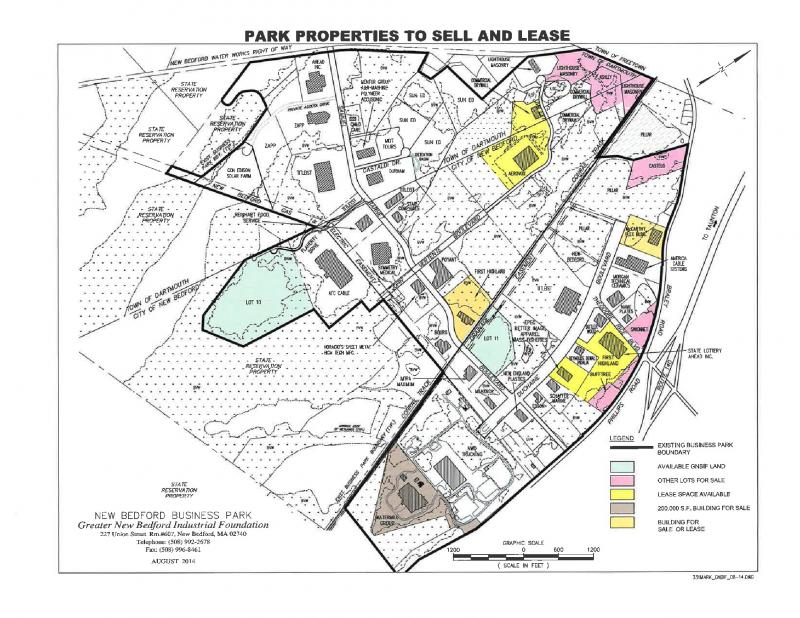

Chief Executive Officer Anne Broholm stepped before the Select Board on June 27 to ask for tax increment financing (TIF) for the 21-year-old company located in the New Bedford Business Park—sections of which are located over the Dartmouth town line.

“We make our living putting logos on hats,” Broholm said to the Board. Ahead, LLC., is currently looking to expand its 97,754 square-foot facility with a 79,000 square-foot addition. The TIF would allow the company to capture a percentage of its property taxes for approximately 10 years—a sum that would normally all go to the town—to support the expansion.

The project would cost an estimated $11 million, said Broholm, breaking that number down into a $9 million cost for the building and $1.5 million for equipment.

“We need the support of the town and state to move ahead in the investment,” she said.

While Broholm promised 25-35 new jobs in the initial three years, along with possible additions to the existing facility, and ensured operations in Dartmouth, Board of Assessors Chairman Robert Michaud had hesitations.

“We’re just about the lowest tax burden community in Massachusetts,” said Michaud, pointing out that big businesses and hospitals recently opened in Dartmouth never asked for a TIF because Dartmouth’s full tax-rate is still lower than New Bedford’s discounted one.

The only reason to grant a TIF, he said, is so that Ahead can receive state aid. Michaud suggested giving Ahead a minimum five-percent of the property tax to boost its initiative. However, the state has built-in guidelines to encourage higher participation.

Broholm and Massachusetts Economic Development Incentive Program (EDIP) Director Annamarie Kersten said that if the TIF is not significant enough, the state can still deny state credits.

The requested TIF is valued at $200,000, but would bring a new incremental tax revenue of about $500,000 to Dartmouth, said Broholm.

Michaud argued that the Town of Dartmouth hasn’t permitted a TIF in 10 years. “Why are we opening that can of worms?” he asked.

Town Administrator David Cressman responded: “The [Massachusetts Office of Economic Development] program of 2016 is not your father’s program of 2007.”

“The equipment they’re going to install—we get an immediate tax benefit on,” said board member John Haran.

“I generally do not believe in TIFs. If they were on the other side of the sign, they’d be paying double,” said Select Board Vice Chairman Frank Gracie. “I do believe it’s proper to revisit not only the time, but the amount.”

Broholm said the company has taken the lower tax rate into account and still believes the request is fair.

Chair of the Greater New Bedford Industrial Foundation and Dartmouth resident, Liz Isherwood, sat in to show her support. “The Industrial Foundation will do anything it can to help the town and help Ahead.”

Isherwood acknowledged that the town would be forfeiting some tax revenue if they approve the TIF, but said Dartmouth would gain more incremental tax revenue. “That’s new tax revenue. It’s a win-win.”

Select Board member Shawn McDonald urged Michaud and the assessors to reassess based on the information presented by Broholm.

“We’re going to negotiate something hopefully and keep them here for a very long time,” said Board Chairman Stanley Michelson.

The Board agreed to discuss and vote on the decision at the next meeting on July 25. If approved, however, the vote would still need to go before Town Meeting members for approval in the fall, said McDonald.

The Ahead company had given the Select Board a tour of the facility on June 13, 2016.